-

IPL 2023: 45% drop in the number of advertisers on TV

There is a 45% decline in the number of advertisers on TV during the first 10 matches of IPL 2023 compared to the last year, according to the BARC India data for Week 14.

The BARC data shows that there were 35 advertisers advertising on television in 2023 versus 64 in 2022.

Among the 35 advertisers this year, 19 are new advertisers.

-

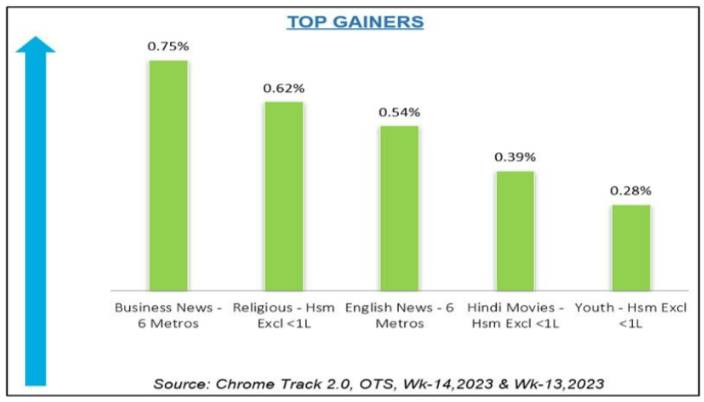

Chrome LIVE Week 14: Business News genre emerges as top gainer with 0.75pc growth

According to Chrome LIVE Week 14’23 data, Business News genre became the top gainer of the week as it grew by 0.75pc in 6 Metros. CNBC Awaaz gained the highest OTS with 76.4pc followed by CNBC TV18 at second position with 75.4pc and ET Now with 66.1pc at third position.

Religious genre claimed the second position as it grew by 0.62pc in HSM excluding <1 lakh market. Sanskar gained the highest OTS with 99.7pc followed by Aastha with 98.3pc at second position. Sadhna moved one spot up with 93.4pc and claimed the third position.

English News genre secured the third position as it grew by 0.54pc in 6 Metros. Sansad TV garnered the highest OTS with 100.0pc followed by Republic TV with 99.8pc at second position and CNN News 18 with 83.8pc at third position.

-

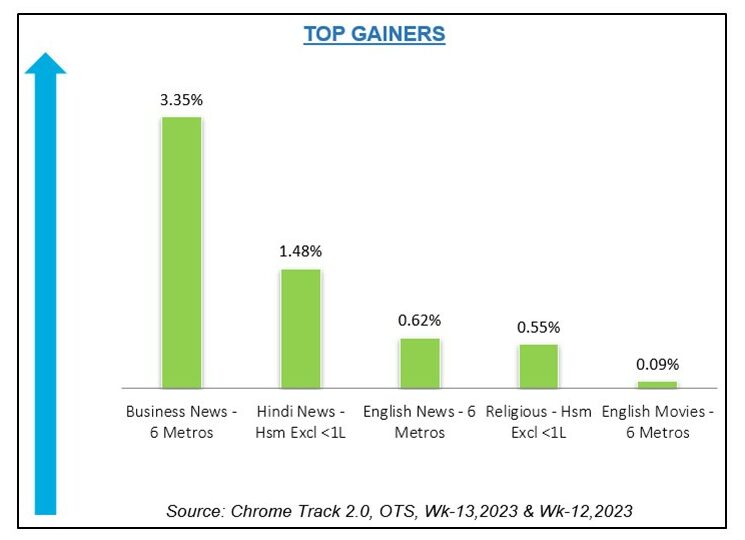

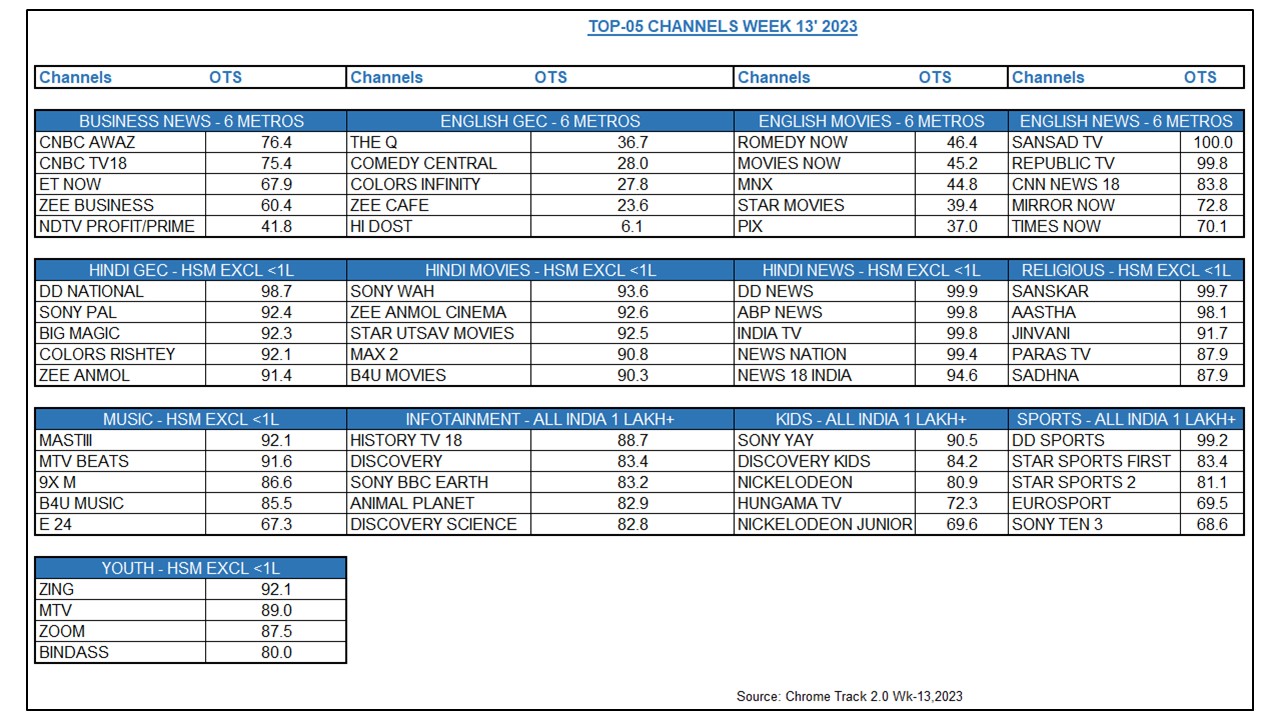

Chrome LIVE Wk 13: Business news genre emerges as top gainer with 3.35pc growth

According to Chrome LIVE Week 13’23 data, Business News genre became the top gainer of the week as it grew by 3.35pc in 6 Metros. CNBC Awaaz gained the highest OTS with 76.4pc followed by CNBC TV18 at second position with 75.4pc and ET Now with 67.9pc at third position.

Hindi News genre claimed the second position by gaining 1.48pc in HSM excluding <1 lakh market. DD News garnered the highest OTS with 99.9pc followed by ABP News and India TV with 99.8pc at second and third positions respectively.

Hindi News genre claimed the second position by gaining 1.48pc in HSM excluding <1 lakh market. DD News garnered the highest OTS with 99.9pc followed by ABP News and India TV with 99.8pc at second and third positions respectively. English News genre secured the third position as it grew by 0.62pc in 6 Metros. Sansad TV garnered the highest OTS with 100.0pc followed by Republic TV with 99.8pc at second position and CNN News 18 with 83.8pc at third position.

-

IPL 2023: DC vs GT peaked at 9.5 mn concurrent unique viewers on JioCinema

On April 4th (Tuesday), Delhi Capitals (DC) went against Gujarat Titans (GT) where the latter claimed its second consecutive win of this season, thus moving GT to the top of Points Table.

India boasts a generous market of internet users by reaching 836 mn subscriptions as of September, 2022. These numbers are projected to reach over 1100 mn internet users by the end of year 2025. Smartphone users capped at 510 mn, Connected TVs crossed the 18 mn mark as of January, 2023.

-

IPL 2023: CSK vs LSG watched by 66 mn unique viewers on JioCinema

In this new age of streaming era, the viewers are increasingly switching their viewing habits online. India boasts a generous market of internet users by reaching 836 million subscriptions as of September, 2022. These numbers are projected to reach over 1100 million internet users by the end of year 2025. Smartphone users capped at 510 million while Connected TVs crossed the 18 million mark as of January, 2023. -

Star Sports reports 67.4% OTS across 165.98 mn C&S homes: Chrome DM Report

The IPL (Indian Premier League) premiered on 1st April, 2023 (Friday), for which Star Sports has the exclusive rights to broadcast their matches live across India. It is a hugely popular tournament where it is known for its dynamic matches, hard hitting batsmen, creative rundowns and inventive strategies, thereby making it a favourite among local sports fans. Moreover, Star Sports provides comprehensive coverage of the IPL including live streaming of matches, analysis and commentary from experts, interviews with players and coaches and behind-the-scenes access to the teams. -

Star Sports in the crosshairs: Will Digital eventually win the battle over IPL media rights?

Star Sports might suffer the collateral damage from this ongoing conflict of digital vs linear over IPL media rights. While digital space is looking more formidable with time, the broadcasting faction is however struggling to gain any position of advantage. And when media warlords see a wounded faction, they go in for the kill! The entertainment business is a battleground where pawns can become kings and queens or get slaughtered for the sake of reigning nobility in the game. If our estimates are to be believed, the ‘Digital’ space could replace over 132 million Cable and Satellite (C&S) households across India. -

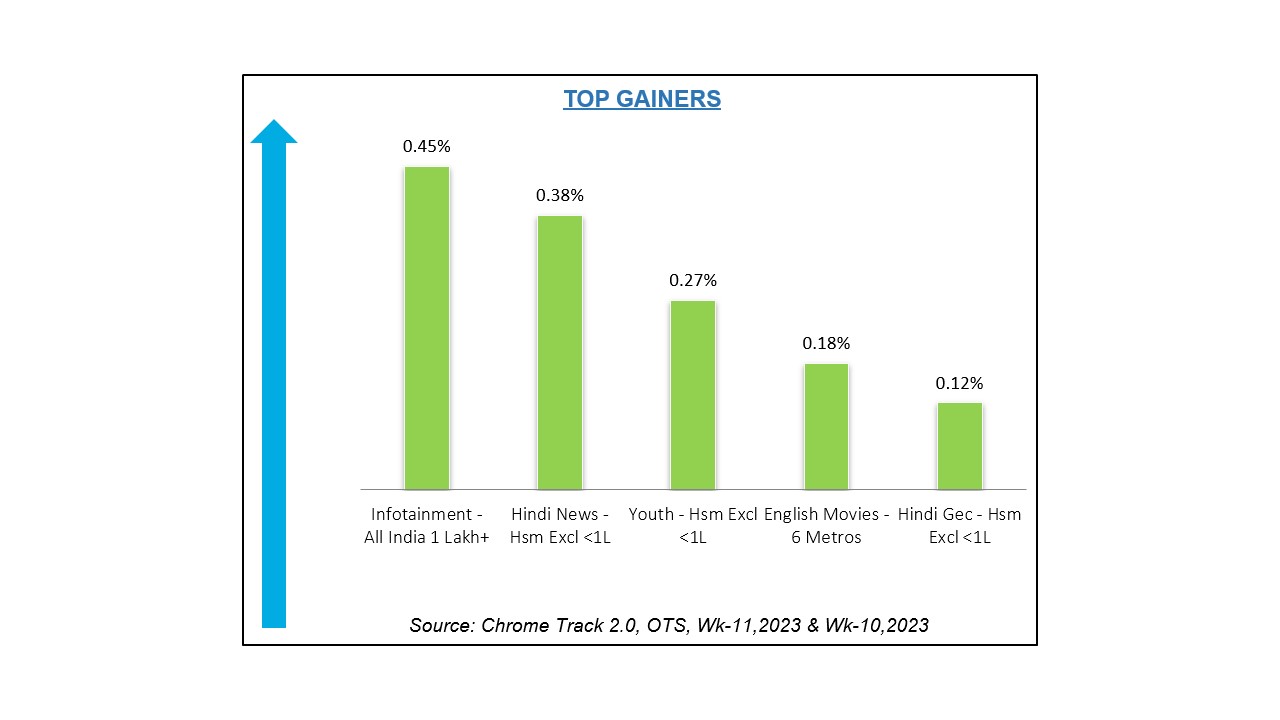

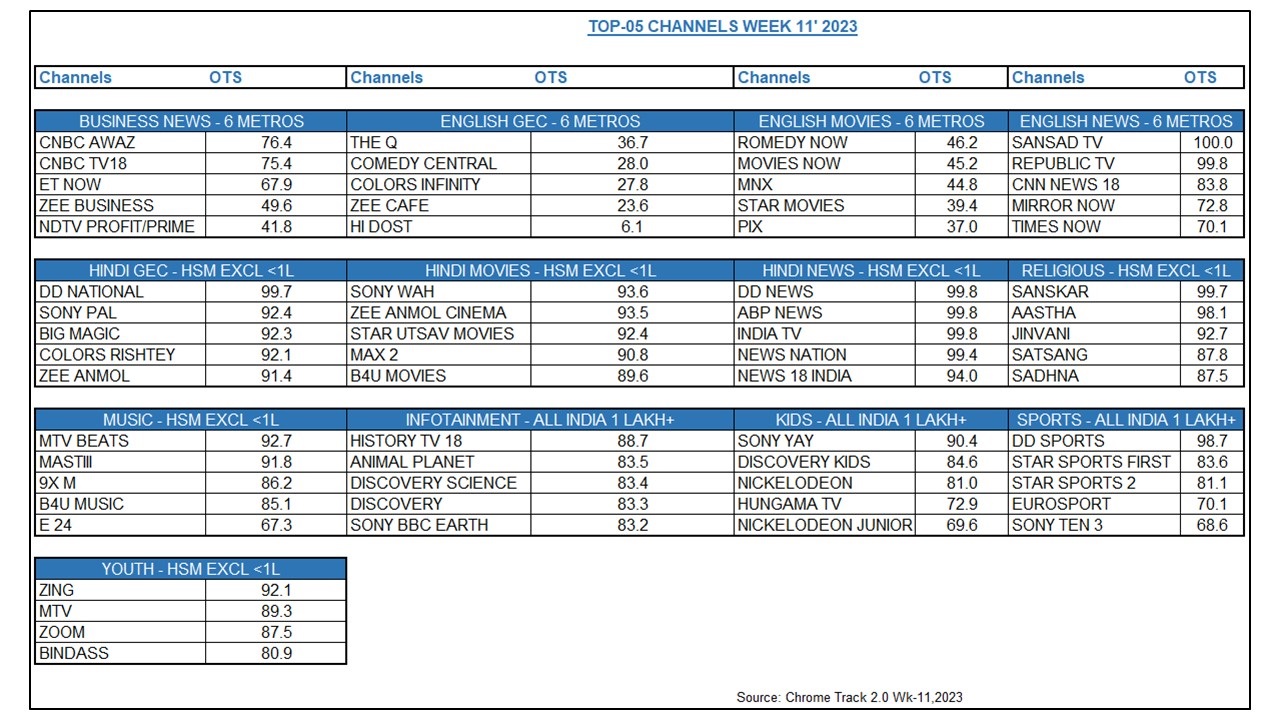

Chrome LIVE Week 11: Infotainment genre emerges as top gainer with 0.45pc growth

According to Chrome LIVE Week 11’23 data, Infotainment genre became the top gainer of the week as it grew by 0.45pc in All India 1 Lakh+ market. History TV18 gained the highest OTS with 88.7pc followed by Animal Planet with 83.5pc at second position and Discovery Science with 83.4pc at the third position.

Hindi News genre claimed the second position by gaining 0.38pc in HSM excluding <1 lakh market. DD News, ABP News and India TV garnered the highest OTS with 99.8pc and stood at first, second and third positions respectively.

Youth genre secured the third position by gaining 0.27pc in HSM excluding <1 lakh market. Zing gained the highest OTS with 92.1pc followed by MTV with 89.3pc at second position and Zoom with 87.5pc at the third position.

-

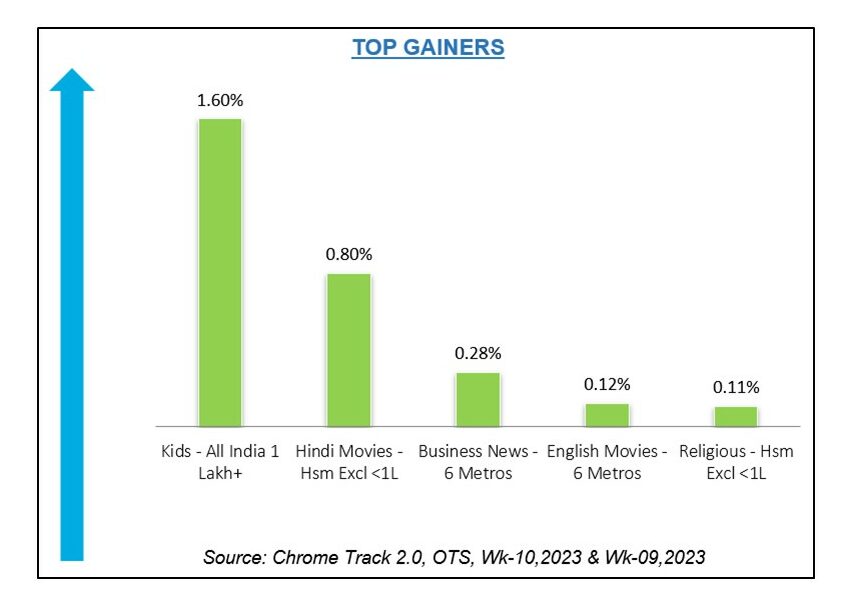

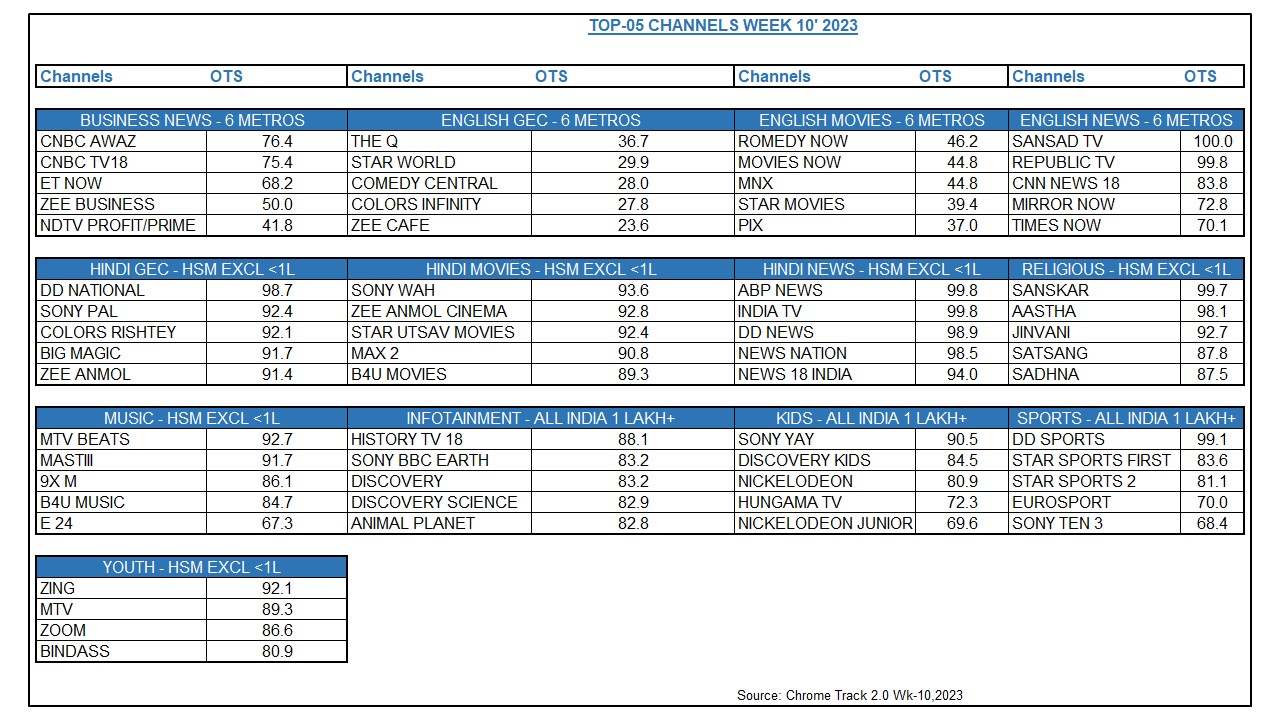

Chrome LIVE Week 10: Kids genre emerges as top gainer with 1.60pc growth

According to Chrome LIVE Week 10’23 data, Kids genre became the top gainer of the week as it grew by 1.60pc in All India 1 Lakh+ market. Sony YAY! garnered the highest OTS with 90.5 pc followed by Discovery Kids with 84.5pc at the second position. Nickelodeon moved two spots up with 80.9pc and stood at third position.

Hindi Movies genre claimed the second position by gaining 0.80pc in HSM excluding <1 lakh market. Sony Wah gained the highest OTS with 93.6pc followed by Zee Anmol Cinema with 92.8pc at second position and Star Utsav Movies with 92.4pc at third position.

Hindi Movies genre claimed the second position by gaining 0.80pc in HSM excluding <1 lakh market. Sony Wah gained the highest OTS with 93.6pc followed by Zee Anmol Cinema with 92.8pc at second position and Star Utsav Movies with 92.4pc at third position.Business News genre secured the third position as it grew by 0.28pc in 6 Metros. CNBC Awaaz moved one spot up and gained the highest OTS with 76.4pc. CNBC TV18 slipped one spot down and stood at second position with 75.4pc. ET Now with 68.2pc retained its third position.

-

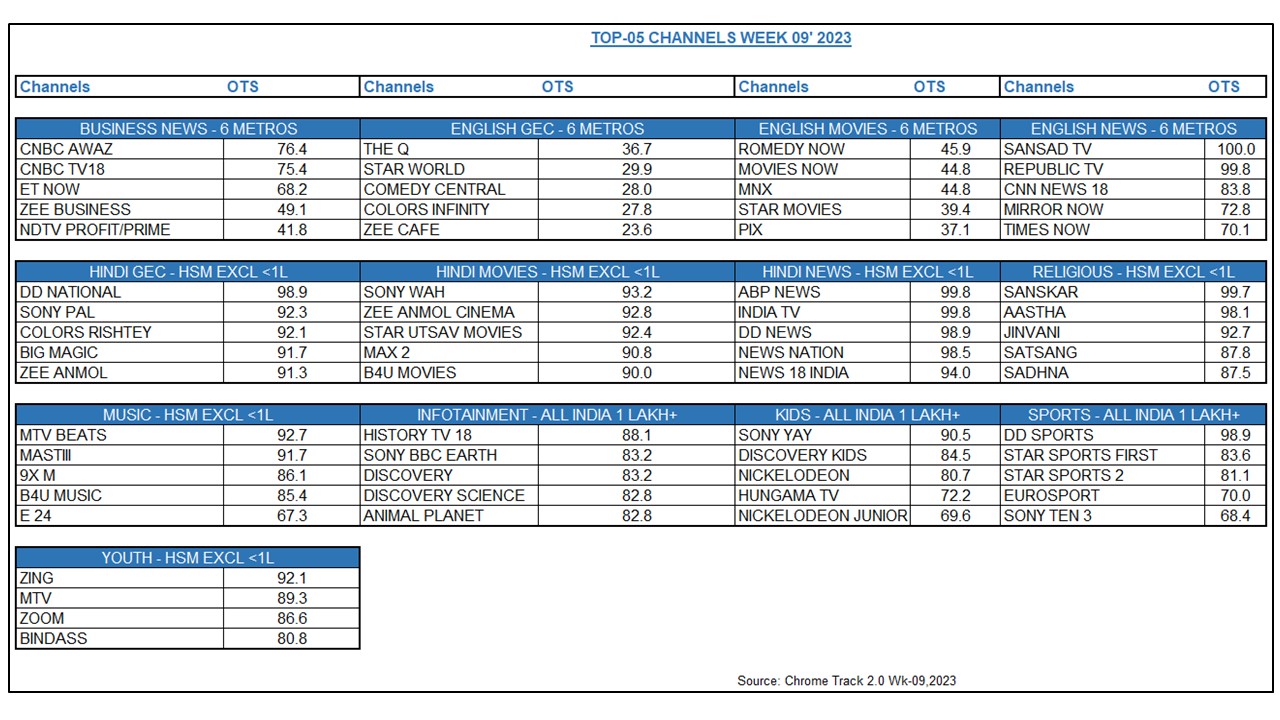

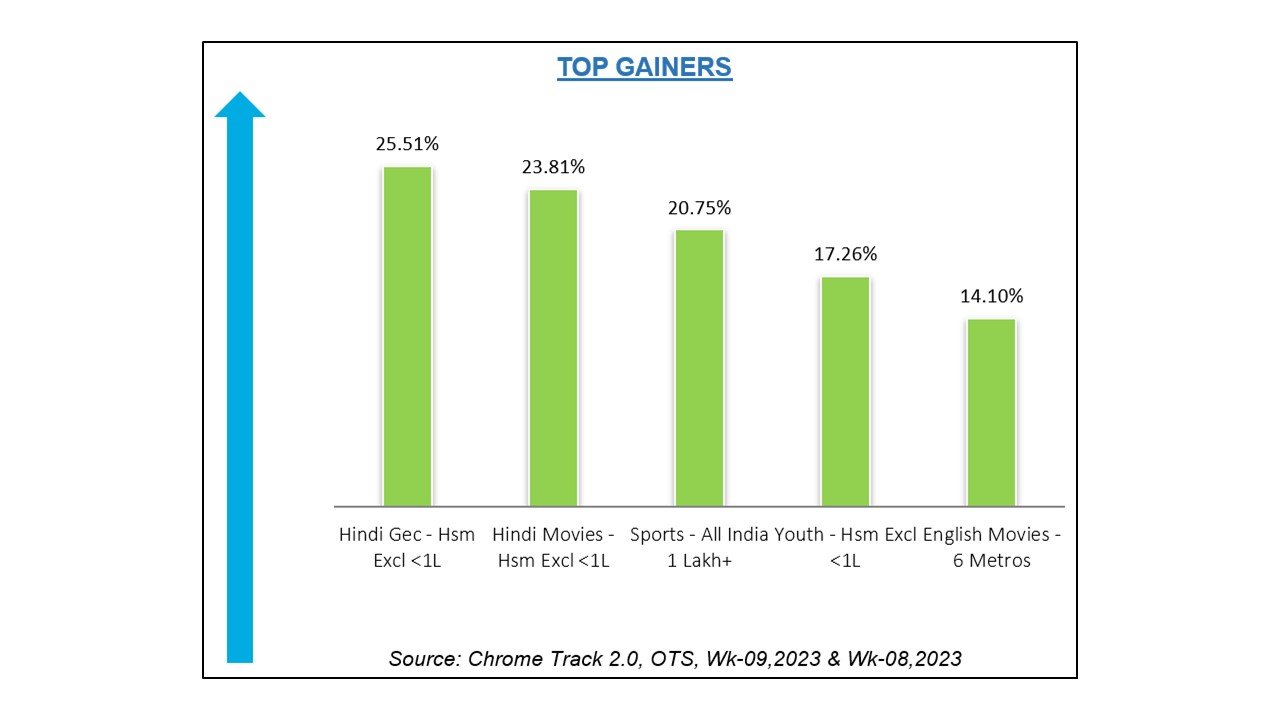

Chrome LIVE Week 9: Hindi GEC genre emerges as top gainer with 25.51pc growth

According to Chrome LIVE Week 9’23 data, Hindi GEC genre became the top gainer of the week as it grew by 25.51pc in HSM excluding <1 lakh market. DD National gained the highest OTS with 98.9pc. Sony Pal claimed the second position with 92.3pc. Colors Rishtey stood at third position with 92.1pc.

Hindi Movies genre claimed the second position by gaining 23.81pc in HSM excluding <1 lakh market. Sony Wah garnered the highest OTS with 93.2pc. Zee Anmol Cinema secured the second position with 92.8pc followed by Star Utsav Movies with 92.4pc at third position.

Hindi Movies genre claimed the second position by gaining 23.81pc in HSM excluding <1 lakh market. Sony Wah garnered the highest OTS with 93.2pc. Zee Anmol Cinema secured the second position with 92.8pc followed by Star Utsav Movies with 92.4pc at third position.Sports genre secured the third position by gaining 20.75pc in All India 1 Lakh+ market. DD Sports gained the highest OTS with 98.9pc followed by Star Sports First with 83.6pc at second position and Star Sports 2 at third position with 81.1pc.